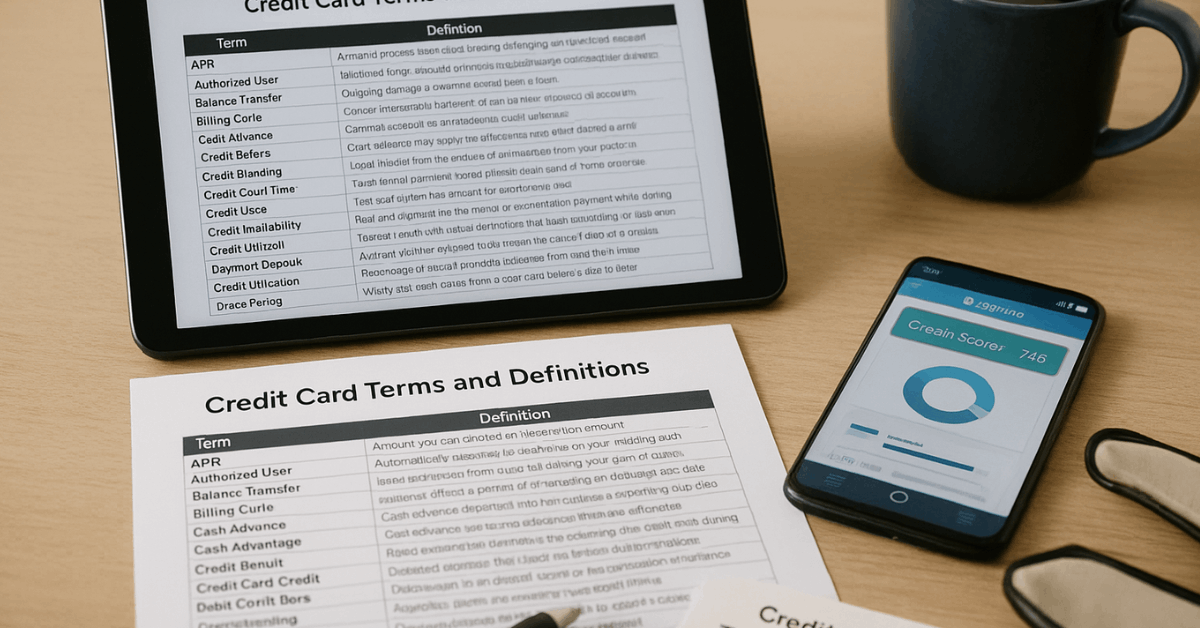

A credit card can strengthen purchasing power worldwide, yet hidden jargon often clouds clear decision-making.

Master the key terms below and you will control costs, build credit, and avoid avoidable penalties.

Why Knowing the Language Protects Your Wallet

Credit card contracts use specialised vocabulary that directly affects fees, interest, and credit scores. Decoding that language before problems arise keeps borrowing affordable and safeguards long-term financial health.

Reading Your Monthly Statement Like a Pro

A statement groups every charge, fee, and adjustment for a single billing cycle. Understanding each field transforms the document from confusing data into an actionable roadmap.

Core Dates That Drive Every Cycle:

- Statement Date (Cut-Off Date): Marks the cycle’s closing day; transactions after this date roll into the next period.

- Payment Due Date: Indicates when at least the minimum amount must reach the issuer to avoid late fees and penalty interest.

Limits and Balances to Track Closely:

- Credit Limit: The maximum amount the issuer allows you to borrow. Approaching or exceeding this ceiling hurts credit utilisation and may trigger over-limit fees.

- Total Amount Due: Reflects all purchases, cash advances, interest, and fees outstanding as of the statement date.

- Minimum Amount Due: The smallest payment, often around 3.5 % of the total balance plus any fixed amortisation, required to keep the account current.

Twenty-Five Essential Terms Every Cardholder Should Recognise

A strong grasp of standard terminology clarifies marketing offers and shields against unexpected costs.

| Category | Term | Practical Meaning |

| Cost of Ownership | Annual Fee | Yearly charge for holding the card; premium rewards cards often impose higher fees. |

| Interest Basics | Annual Percentage Rate (APR) | Yearly interest on carried balances; divide by 12 for the monthly rate. |

| Fixed APR | Interest that remains steady unless the issuer gives formal notice. | |

| Variable APR | Interest that moves with the prime rate, rising or falling accordingly. | |

| Introductory APR | Temporary lower or 0 % rate on purchases or transfers for 6-21 months. | |

| Penalty APR | Elevated rate applied after significant late payments. | |

| Purchase APR | Standard rate applied to new purchases after any intro period ends. | |

| Balance Management | Balance | Total amount owed, including fees and interest. |

| Credit Utilisation Rate | Percentage of credit limit currently used; keep below 30 % for healthier scores. | |

| Minimum Payment | Lowest sum required each month; paying only this prolongs debt and increases interest. | |

| Billing Cycle | Period between statement closing dates; legally at least 21 days. | |

| Transfers & Advances | Balance Transfer | Moving debt to a new card, often at 0 % intro APR, to reduce interest costs. |

| Balance Transfer Fee | Typically 3-5 % of the amount moved, with minimums around US $5-10. | |

| Balance Transfer APR | Rate that applies after any promotional period on transferred balances. | |

| Cash Advance | Cash withdrawn against the card, usually at higher APR and with immediate interest. | |

| Cash-Advance Fee | Around 5 % of the amount, added instantly to the balance. | |

| Cash-Advance APR | One of the highest rates on the card, accruing from day one. | |

| Fees & Charges | Foreign Transaction Fee | Around 3 % surcharge on purchases outside the home currency; some cards waive it worldwide. |

| Late-Payment Fee | Up to US $29 for a first offence, rising for repeated misses within six cycles. | |

| Credit Infrastructure | Credit Bureau | Agency that collects payment data; Experian, Equifax, and TransUnion dominate worldwide reporting. |

| Credit Report | Detailed file of open lines, balances, and payment history. | |

| Credit Score | Three-digit indicator (300-850 FICO) summarising risk to lenders. | |

| Prime Rate | Benchmark rate banks charge top borrowers; many variable APRs track this figure. | |

| Grace Period | Minimum 21-day window after the cycle ends in which new purchases avoid interest if the prior balance is paid in full. |

How a Credit Card Functions Day to Day

A credit card extends a revolving line of credit that can fund purchases at millions of merchants worldwide. You borrow now, then repay either entirely during the grace period to avoid interest or over time with interest added.

Issuers also allocate a separate cash advance limit that carries no grace period and higher charges, making it an option only for urgent cash needs.

Interest compounds based on the issuer’s calculation method. Some calculate daily, which increases total interest when balances linger. Others calculate monthly, slightly lowering costs. Reading the cardholder agreement reveals the method.

Major Card Types and Their Typical Uses

Different card structures match varied borrowing goals and credit profiles.

Rewards Cards

Earn points, miles, or cash back on spending. They usually carry higher APRs and may charge annual fees, yet the perks offset costs when balances are paid in full monthly.

Store and Co-Branded Cards

Issued in partnership with retailers, these cards often feature easier approval and targeted discounts. Store-only versions restrict usage to the merchant’s locations, while co-branded Visa or Mastercard variants work everywhere.

Secured Cards

Require a cash deposit equal to the line of credit. Ideal for building or rebuilding credit, deposits are refundable after demonstrated responsible use.

Prepaid Debit Alternatives

Operate on deposited funds without extending credit. They help control spending but do not build credit history because activity typically goes unreported.

Interest Rates and Fees: What Drives the Numbers

Card pricing reflects both market conditions and borrower behaviour. The prime rate shifts when central banks adjust monetary policy, driving variable APR up or down. Fixed APR remains steadier yet still can change with notice.

Carrying balances above the grace period costs money daily. Late payments can trigger penalty APR, raising borrowing costs dramatically. High utilisation can also lower credit scores, which in turn may limit access to better rates.

Building Strong Credit History Worldwide

Every on-time payment writes a positive entry on reports maintained by major bureaus in your region. Consistent punctuality, low utilisation, and limited hard inquiries lift scores over time.

If credit history is thin, consider these steps:

- Open a Secured Card – Deposit funds, use the card, and pay on time.

- Become an Authorised User – Link to a trusted borrower’s seasoned account.

- Maintain Long-Held Lines – Keep older accounts open to preserve average age.

Closing long-standing cards reduces available credit and shortens history length, both of which may lower scores.

Starting Safely When Credit Is New

Entering the credit system can feel circular: little history limits approval, yet approval is needed to build history.

A secured credit card breaks the loop by reducing lender risk. Alternatively, some issuers offer starter cards with low limits and no annual fees.

When choosing a first card, compare:

- Annual fee versus expected rewards.

- Introductory APR period length.

- Ongoing purchase APR after promos.

- Reporting policy to credit bureaus (ensure monthly reporting).

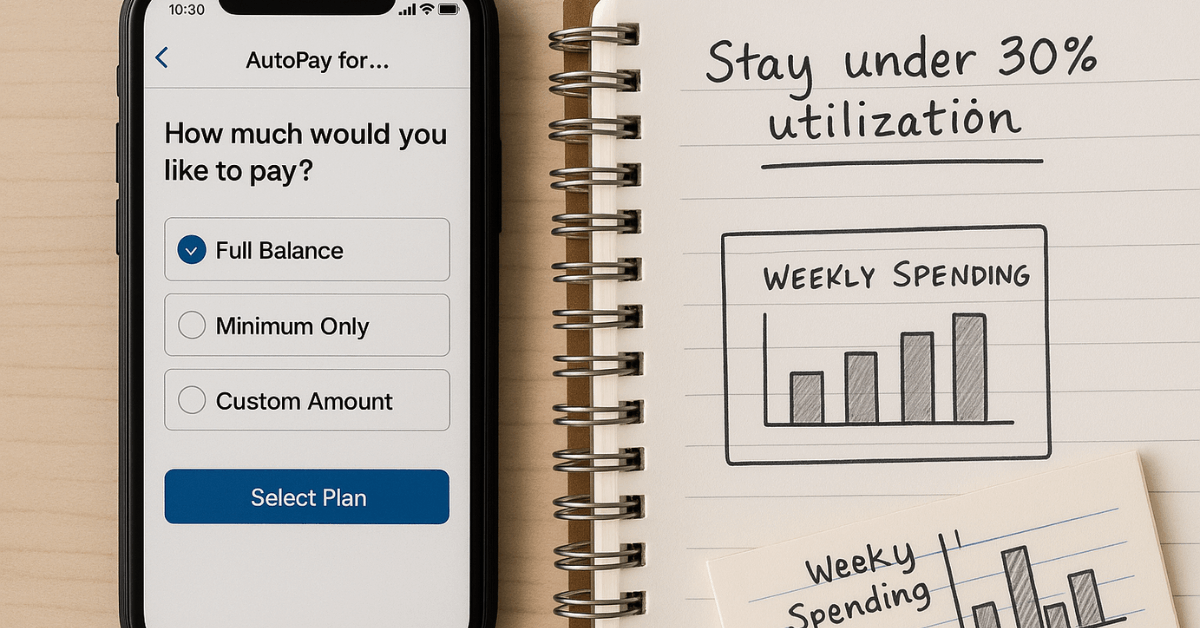

Practical Management Tips for Every Cardholder

A few disciplined habits keep charges predictable and scores healthy.

- Create a Budget Aligned with the Statement Cycle: Schedule purchases early in the cycle for up to 51 days of float before payment.

- Set Automatic Payments for at Least the Minimum: Prevent late fees and protect credit health.

- Monitor Utilisation Weekly: Aim to stay under 30 % of the limit, ideally under 10 % for top score impact.

- Pay Cash Advances Immediately: Eliminate daily interest accumulation.

- Review Statements for Errors: Dispute unfamiliar charges within the issuer’s specified timeframe.

- Travel with No-Foreign-Fee Cards: Avoid unnecessary conversion costs worldwide.

- Evaluate Rewards Against Fees Annually: Keep cards that return more value than they cost.

Transaction Date Versus Posting Date

A transaction enters the system on the day of purchase, then shifts to pending status. It posts once the merchant clears the charge, usually within two days.

The posting date determines when the amount begins affecting the balance and potentially accruing interest.

Frequently Asked Structural Questions

You might ask these questions along the way:

- Do cards carry fixed or variable APR?

Many issuers apply variable rates to purchases and fixed rates to certain promotional balances. The cardholder agreement lists each segment. - What triggers an annual fee increase?

Issuers can adjust fees with advance notice, often aligning changes with new reward structures or broader market shifts. - Can another credit card pay the bill?

Issuers rarely allow one card to cover the minimum on another directly; electronic transfers from a bank account or debit card are usually required.

Conclusion

Mastering credit card terminology equips you to select the right card, sidestep costly fees, and nurture a robust credit profile.

Apply the concepts above, scrutinise every statement, and practice disciplined repayment, and your credit card will serve as a flexible financial tool rather than an expensive burden.