Using the right rewards card turns your everyday spending into something more valuable.

Instead of letting purchases end at checkout, rewards programs convert them into cash, points, or miles that build up over time.

When managed well, these cards reduce travel costs, offer meaningful perks, and help you make the most of the money you were already going to spend.

What are Rewards Credit Cards?

A rewards credit card links every eligible transaction to a rebate system that converts spending into cash, points, or miles. You build balances automatically, then redeem them for merchandise, statement credits, or travel perks.

How Rewards Accrue

Most issuers attach a conversion rate to each purchase category. Higher rates apply to strategic areas such as dining or supermarkets, while everyday buys often earn a base rate.

Influencing Factors:

- Spending category multipliers adjust point totals.

- Foreign transaction rates can affect net value when you purchase abroad.

- Expiry policies decide how long balances remain usable.

Main Types of Credit Card Rewards

You maximise card value when you match your lifestyle to a compatible reward structure.

Cash-Back Programs

Cash-back cards return a fixed percentage of your spend as statement credits or direct deposits. Payouts are predictable, and no conversion math is required.

Points Schemes

Points cards attach a numeric value to each unit of currency spent. You later trade accumulated points for gift cards, merchandise, or statement credits. Some issuers let you offset the annual fee with points.

Travel Miles

Travel cards convert spending into airline or hotel miles. Redemptions cover award flights, upgrades, or free nights. Flexible programs transfer miles to multiple partners, offering broader value than single-brand schemes.

Choosing the Right Rewards Card

Selecting a card that aligns with your habits protects you from hidden costs while boosting long-term benefits.

Analyse Your Spend Pattern

Review recent statements and identify dominant categories such as groceries, fuel, or online retail. A card that multiplies points in those areas accelerates earnings.

Check Reward Valuation

One point in one program may equal half a cent, while another can exceed two cents when transferred strategically. Confirm average redemption values before committing.

Weigh Fees Against Gains

Annual fees often unlock premium benefits, yet they only make sense when projected rewards exceed the cost. High interest charges erase reward gains if balances roll over.

Verify Eligibility Requirements

Income thresholds and credit-score minimums vary worldwide. Confirm you meet baseline criteria to avoid unnecessary credit inquiries.

Sample High-Value Rewards Cards Worldwide

The table contrasts popular options available in multiple regions. Features change by market, so confirm local terms.

| Card | Reward Rate Core | Notable Multipliers | Annual Fee | Distinct Perks |

| BPI Blue Mastercard | 1 pt / ₱35 spend | — | ₱1,550 (first year waived) | 0 % instalment up to 36 months, low forex markup |

| UnionBank Gold Visa | 1 pt / ₱35 spend | Non-expiring points | ₱2,500 | Free airport lounge, life insurance cover |

| Citi Rewards Card | 1 pt / ₱30 spend | 3× on dining & shopping | ₱0 for life | Global merchant discounts up to 50 % |

| Security Bank Gold Mastercard | 1 pt / ₱20 spend | Non-expiring points | ₱2,500 (first year waived) | Unlimited Marhaba Lounge access |

| RCBC Flex Visa | 1 pt / ₱50 spend | 2× on two chosen categories | ₱1,500 | Category switch each cycle, travel insurance |

| Blue Cash Preferred® | 6 % cash back on US supermarkets* | 6 % streaming, 3 % fuel & transit | US$95 (first year $0) | Intro APR 0 % on purchases |

| Chase Sapphire Preferred® | 1 pt / $1 spend | 5× on travel via Chase, 3× dining | US$95 | 1.5× value through Chase Travel |

| Wells Fargo Active Cash® | 2 % cash rewards | — | US$0 | Intro APR 0 % on purchases & transfers |

Regional supermarket definition applies only inside the United States.

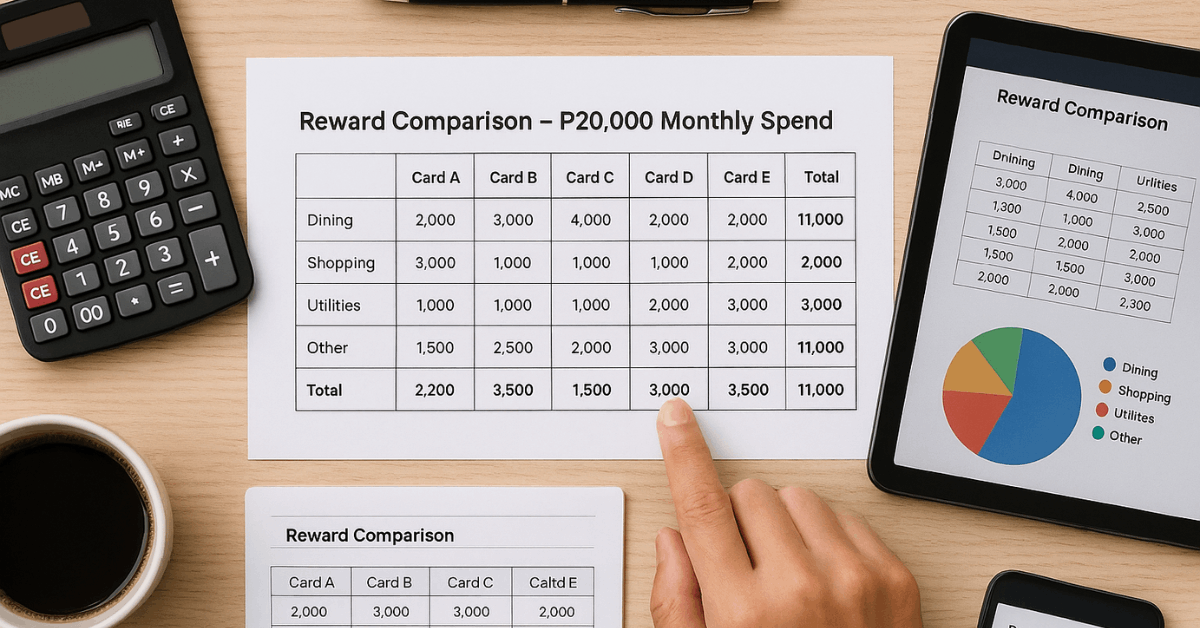

Monthly Reward Scenario

The illustration converts a ₱20,000 monthly spend into points using local Philippine options. Results inform how quickly balances grow.

| Card | Dining & Shopping ₱10,000 | Other Spend ₱10,000 | Monthly Total |

| BPI Blue Mastercard | 285.71 pts | 285.71 pts | 571.42 pts |

| UnionBank Gold Visa | 285.71 pts | 285.71 pts | 571.42 pts |

| Citi Rewards Card | 1,000 pts | 333.33 pts | 1,333.33 pts |

| Security Bank Gold Mastercard | 500 pts | 500 pts | 1,000 pts |

| RCBC Flex Visa | 400 pts | 200 pts | 600 pts |

Citi Rewards unlocks rapid gains in dining and retail, while Security Bank delivers predictable value across any category thanks to the lowest spend-per-point ratio.

Maximising Reward Value

Redeeming points correctly safeguards hard-earned value.

Align Redemptions to High-Value Options

Points are worth different amounts depending on how you use them.

Booking flights, especially international or premium seats, often gives you 1.5 to 2× more value per point compared to using them for statement credits or gift cards. Focus on redemptions that offer a better return per point.

Stack Promotional Bonuses

Combine sign-up bonuses, rotating category boosts, and merchant-specific promos to accelerate balances without inflating normal spending.

Avoid Expiry Losses

Set calendar reminders or opt for cards with non-expiring points to protect balances during periods of low spending.

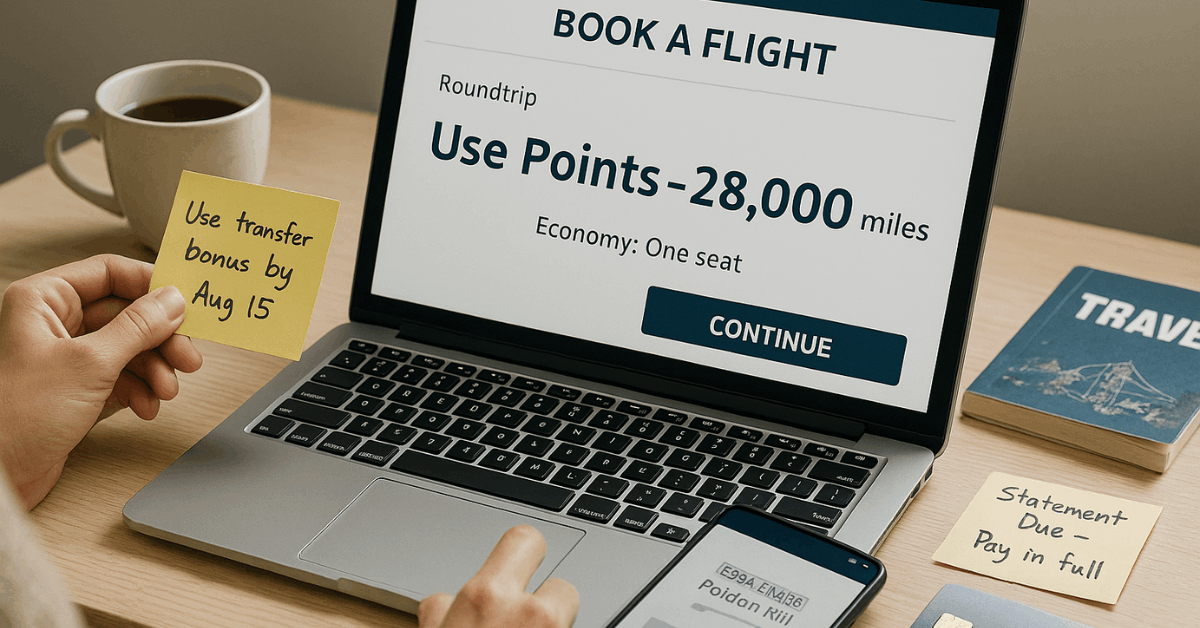

Monitor Transfer Ratios

Some programs run limited-time 20 %–30 % transfer bonuses to partner airlines, lifting effective value per point.

Common Pitfalls and How to Avoid Them

A strategic approach prevents reward chasing from becoming costly debt.

- Carrying balances: Interest rates can exceed 20 % worldwide, wiping out reward gains. Pay statements in full each cycle.

- Ignoring fees: Lounge visits or balance transfers may add hidden surcharges. Review the fee schedule before redeeming or moving balances.

- Overspending for bonuses: Purchasing unnecessary items dilutes net value. Stick to essential outlays and let rewards accumulate organically.

- Missing minimum spend deadlines: Sign-up bonuses usually require a threshold within 90 days. Plan large annual expenses—insurance premiums or tuition payments—to hit targets efficiently.

Bottom Line

Reward credit cards transform ordinary purchases into tangible benefits when you align card features with personal spending habits and redemption preferences.

Evaluate your dominant categories, compare global card options, and confirm that projected earnings outpace fees.

Pay each statement completely, leverage promotional multipliers, and treat points or miles as a savings tool rather than an excuse to overspend. With disciplined use, a well-chosen rewards card delivers worldwide value on every swipe.