Opening a credit line during college gives you a real head start. By using a student credit card responsibly, you begin shaping your credit history early, which affects everything from future loan rates to apartment applications.

Even a modest spending limit, when paid off consistently, builds trust with lenders and keeps your financial options open after graduation.

Build Credit Early to Protect Future Plans

Starting college often means signing a first lease, buying books, and planning travel during breaks, all activities that run more smoothly when you already show responsible credit behavior.

A student-focused credit card gives you a controlled way to record on-time payments and lengthen your credit history while still at school, positioning you worldwide for lower loan rates and easier approvals later in life.

Why Credit History Matters During School

Keeping a healthy score affects everything from utility deposits to graduate-school loan pricing.

A solid payment record also lets you negotiate better mobile-phone plans and insurance premiums once you leave campus. Add these gains up and you protect thousands of dollars over the next decade.

- Lower borrowing costs: Good scores prompt lenders to quote friendlier APRs on cars, personal loans, and mortgages.

- Simpler apartment applications: Many landlords skip extra security deposits when an applicant shows strong credit.

- Career flexibility: Some global employers check credit during background reviews, especially for finance or government roles.

How Student Credit Cards Work

A student credit card mirrors a standard card yet carries guardrails suited to limited income and thin credit profiles. You stay in charge of your budget while issuers limit risk on their side.

Credit Limits

Expect an initial line between USD 300 and USD 2,000. This modest ceiling discourages large balances and simplifies payment tracking.

Interest Rates

Variable rates on student products usually sit several points higher than mainstream cards. Pay your monthly statement in full to avoid interest entirely; otherwise, the cost of carrying a balance can erase any rewards.

Rewards and Perks

Issuers increasingly offer genuine cash-back programs, bonus match offers, and grade incentives. Discover’s student lineup offers automatic first-year cash-back matching, effectively doubling your earnings for 12 months.

Approval Requirements

Most student cards accept applicants with no previous credit history. A part-time job or regular allowance still strengthens the application because issuers must verify the ability to repay.

Top Student Credit Cards for 2025

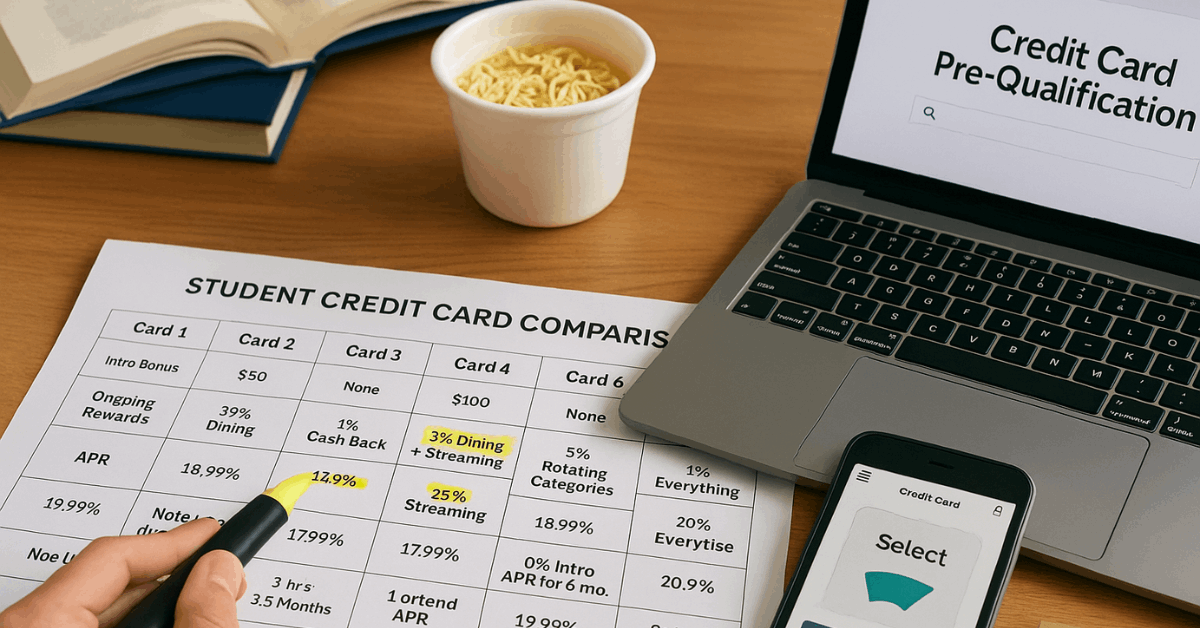

Choosing a “best” card depends on your spending pattern, not just headline bonus figures.

The six options below combine no annual fees, competitive rewards, and lenient qualification rules as of July 30, 2025.

| Card | Ideal For | Annual Fee | Intro Bonus | Ongoing Rewards* |

| Discover it® Student Cash Back | Rotating category maximizers | $0 | First-year Cashback Match | 5% in quarterly categories (activation required) |

| Discover it® Student Chrome | Frequent drivers or diners | $0 | First-year Cashback Match | 2% on gas and restaurants (up to $1,000 quarterly) |

| Capital One Quicksilver Student Cash Rewards | Simple flat-rate cash back | $0 | $100 after $100 spend | 1.5% on all purchases; 5% on Capital One Travel hotels and cars Capital One |

| Capital One Savor Student Cash Rewards | Off-campus living | $0 | $100 after $100 spend | 3% on dining, groceries, entertainment, streaming; 8% on Capital One Entertainment |

| Bank of America Customized Cash Rewards Student | Category control | $0 | $200 online cash bonus | 6% in chosen category first year, then 3%; 2% grocery/wholesale club Bank of America |

| Bank of America Unlimited Cash Rewards Student | Straightforward cash back | $0 | $200 online cash bonus | 1.5% on all purchases |

*Rates and perks verified July 30, 2025, and may change.

Discover it Student Cash Back

You earn 5% on rotating categories such as grocery stores or digital wallets, subject to a quarterly cap after activation, and 1% on everything else.

Discover matches the entire first-year haul, doubling your initial return without extra effort. The variable APR currently ranges from 17.24% to 26.24%, and there is no annual fee.

Discover it Student Chrome

If weekend road trips or restaurant meet-ups dominate your budget, this card’s permanent 2% rate on gas and restaurant tabs (up to USD 1,000 combined each quarter) keeps rewards predictable.

The same first-year Cashback Match applies, amplifying early earnings.

Capital One Quicksilver Student Cash Rewards

Flat 1.5% cash back means no category tracking, while bookings through Capital One Travel receive 5%.

Entertainment purchases through Capital One earn an elevated 5% until at least December 31, 2025, helpful for streaming concerts or sports packages worldwide.

Capital One Savor Student Cash Rewards

Students who cook at home and unwind with music or movies gain 3% back on groceries, dining, streaming, and live entertainment.

An automatic $100 bonus arrives once you spend $100 within three months, reinforcing careful spending habits.

Bank of America Customized Cash Rewards Student

You select a 6% category (restaurants, online shopping, gas, travel, drugstores, or home improvement/furnishings) for the first year, then 3% after that promotion ends.

Coupled with 2% at grocery stores and wholesale clubs, the structure suits planners who want to match rewards to upcoming semesters abroad or dorm setup costs.

Bank of America Unlimited Cash Rewards Student

When you prefer a straightforward rate, Unlimited Cash Rewards delivers 1.5% back on every purchase plus a $200 bonus after qualifying spend.

Link the card to a Bank of America checking account to enable automatic statement payments and safeguard against missed due dates.

Factors That Deserve Close Attention

A shiny bonus alone should not drive your decision. Evaluate the following aspects before applying.

- Variable APR range: Lower APRs matter if unexpected expenses might force you to carry a balance temporarily.

- Foreign transaction fees: Students studying abroad or ordering supplies from international sellers should favor cards that waive these charges.

- Credit reporting cadence: Most major issuers report to all three U.S. bureaus every month, accelerating score building.

- Digital tools: Mobile alerts, budgeting dashboards, and free FICO® updates make it easier to track spending in real time.

How to Qualify and Apply

Setting up your first credit line does not take long when you prepare documents early.

- Check your existing credit file through a free annual report or issuer-provided score.

- Compare at least three cards against your spending habits, bonus timelines, and travel plans.

- Assemble documentation: government-issued ID, Social Security number or equivalent, proof of income, and school enrollment verification if requested.

- Submit the online application and review the electronic disclosures carefully before accepting.

- Activate the card on arrival and load digital wallets to enable instant usage.

Many issuers offer soft-pull prequalification tools that estimate approval odds without affecting your score. Use them to avoid unnecessary hard inquiries.

Responsible Use: Habits That Build Credit Faster

Smart behavior today prevents expensive headaches tomorrow. Follow these guidelines once your card is active.

- Pay every statement in full and on time. Automate transfers from a checking account to eliminate memory lapses.

- Keep utilization below 30% of the credit limit; lower is better. Regularly pay mid-cycle if heavy spending is unavoidable.

- Review transactions weekly to catch errors or fraud quickly, especially when traveling worldwide.

- Ignore reward hype. Never purchase items solely for points or cash back; interest charges can dwarf any rebate.

- Request credit-limit increases only after six months of spotless payments to avoid hard pulls during the fragile first year.

Alternatives When a Student Card Is Out of Reach

Denied applications or personal hesitation need not stall your credit journey.

Secured Credit Cards

Placing a refundable deposit equal to your limit gives issuers confidence to approve thin-file applicants. Responsible use can upgrade the account to unsecured status within 12 months.

Authorized-User Status

Joining a parent or guardian’s long-established card transfers their positive history to your report. Agree on spending limits and repayment rules upfront to protect both parties.

Small Personal Loans

Credit-builder loans or low-limit bank loans report to bureaus like credit cards. Set the loan amount aside in savings to ensure flawless monthly payments.

Comparing Cards Across Borders

Although many headline offers target U.S. residents, the evaluation framework—annual fee, effective rewards rate, reporting frequency, and digital management tools—applies worldwide.

Students in Canada, the United Kingdom, Australia, and emerging markets should apply the same criteria when reviewing local options, even if product names differ.

Ongoing Maintenance After Graduation

Most issuers automatically convert student accounts into the standard version once you leave school.

Continue using the card lightly each month to preserve credit-age benefits and avoid closure for inactivity.

You may also negotiate product changes to a richer rewards program while retaining the original opening date.

Conclusion

A student credit card serves as a low-risk training ground for larger financial responsibilities.

Select the card whose rewards align with your lifestyle, automate full monthly payments, and monitor spending through each semester.

Treat the account as a tool rather than extra cash, and you will exit college with a solid worldwide credit profile and without burdensome debt.