Keeping a credit card active, while managing it carefully, remains one of the fastest ways for consumers worldwide to move a mediocre credit score into the preferred ranges lenders reward with lower rates and higher limits.

The sections below explain, step-by-step, how you can turn everyday card use into a reliable credit-building routine without slipping into costly debt.

Credit Score Fundamentals and Why They Matter

Good credit unlocks practical advantages such as easier approval for mortgages, personal loans, and rental applications.

And along with lower insurance premiums in many regions worldwide.

Every mainstream scoring model still evaluates five core data categories, each weighted by importance:

| Scoring Factor | Typical Weight | What the Factor Measures |

| Payment history | 35 % | Timeliness of every reported payment |

| Amounts owed | 30 % | Balances versus available credit, especially on revolving lines |

| Length of credit history | 15 % | Age of oldest account, newest account, and overall average age |

| Credit mix | 10 % | Variety of installment and revolving accounts in good standing |

| Recent inquiries and new credit | 10 % | Number of hard pulls and recently opened accounts |

Staying focused on these components prevents wasted effort on tactics that scoring algorithms barely register.

Seven Credit-Building Strategies That Work

The techniques below attack the exact data points scoring formulas monitor. Combine several for faster, lasting gains.

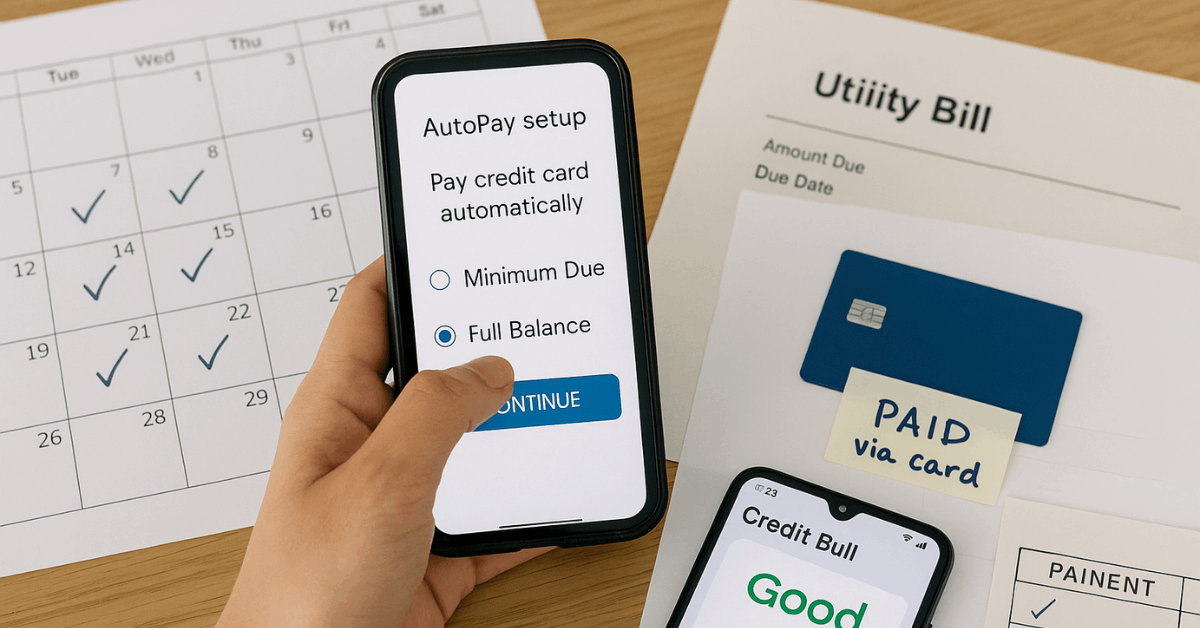

1. Make On-Time Payments Every Billing Cycle

Card issuers report payment activity to worldwide credit bureaus once each month, and scoring models treat missed or late payments as the highest-impact negative mark.

Setting automatic payments for at least the minimum due, plus calendar reminders for larger manual pay-offs, virtually eliminates accidental lateness while proving consistent reliability.

Quick action checklist:

- Activate autopay for the minimum due within your online banking dashboard.

- Schedule an additional manual payment two days before the due date to wipe out most or all of the remaining balance.

- Enroll in utilities- or rent-reporting services if available; on-time records broaden positive payment data without extra debt.

2. Pay Down Revolving Balances to Shrink Utilization Ratios

Credit utilization shows how much revolving credit you employ versus what is available. Ratios below 10 % support elite scores, while ratios above 30 % can drag scores south quickly.

Effective payoff approaches:

- Debt avalanche: Target the highest-interest balance first, then roll freed funds into the next card; this route minimizes total interest paid.

- Debt snowball: Knock out the smallest balance first for quick morale wins before tackling larger accounts.

- Balance transfer card: Shift high-rate debt onto a 0 % promotional offer and attack the principal aggressively during the interest-free window.

- Debt consolidation loan: Replace several card payments with one fixed-rate installment loan, lowering utilization across all cards immediately.

Issuers usually update the reported balance soon after each monthly statement closes, so reductions often translate into measurable score gains within one or two reporting cycles.

3. Keep Your Oldest Credit Card Active

Length of history grows only with time, making it the one factor you cannot accelerate artificially. Closing a well-aged card slashes average account age and shrinks overall available credit, both of which may drag scores lower.

Maintenance tips:

- Put a small recurring subscription, such as a streaming service, on the oldest card and pay it automatically.

- If the card carries an annual fee but no longer fits your spending pattern, ask the issuer for a product change to a no-fee variant rather than closing the account.

4. Diversify Account Types Gradually

Scoring formulas reward borrowers who handle multiple credit forms—installment and revolving—responsibly. A healthy blend might include a student loan, an auto loan, and at least one credit card. Still, adding accounts solely for mixed benefits rarely outweighs the cost of unnecessary debt.

Practical diversification routes:

- Open a small credit-builder loan offered by many community banks or credit unions.

- Consider a low-limit store card if you shop with that retailer regularly and can settle the bill monthly.

- Avoid stacking applications; spread credit requests over time to protect the inquiry section of your report.

5. Limit Hard Inquiries and Time New Applications Strategically

Each full application triggers a hard inquiry that can trim several score points for up to twelve months. Multiple inquiries clustered within a brief span magnify the effect unless scored as rate-shopping for a single loan type.

Smart application habits:

- Use pre-qualification tools featuring soft inquiries to gauge approval odds.

- Group mortgage, auto, or student-loan rate shopping within a two-week window so scoring models treat the inquiries as one event.

- Skip applying for additional cards until major purchases, such as a home loan, have closed.

6. Dispute Errors Promptly

Worldwide credit bureaus occasionally post incorrect late payments, duplicate accounts, or fraudulent lines created through identity theft. Each erroneous derogatory mark can undercut your score by double digits.

Dispute workflow:

- Download free copies of all three bureau reports through the official reporting portals.

- Highlight unfamiliar entries or balances that appear incorrect.

- File online disputes with each bureau, attaching any supporting documents.

- Monitor results; bureaus must respond within 30 days in most jurisdictions.

7. Leverage Authorized-User Status When Appropriate

Being added to a relative’s or partner’s well-managed credit card transfers the account’s age, limit, and payment history to your file. Score impact depends on the primary cardholder’s discipline.

Best-practice considerations:

- Confirm the card shows a flawless payment history and low utilization.

- Verify that the issuer reports authorized-user data to all major bureaus.

- Agree on spending rules; no purchase should jeopardize the primary user.

Choosing the Right Starter or Rebuilding Card

Selecting an initial credit product that fits current circumstances removes friction and accelerates progress.

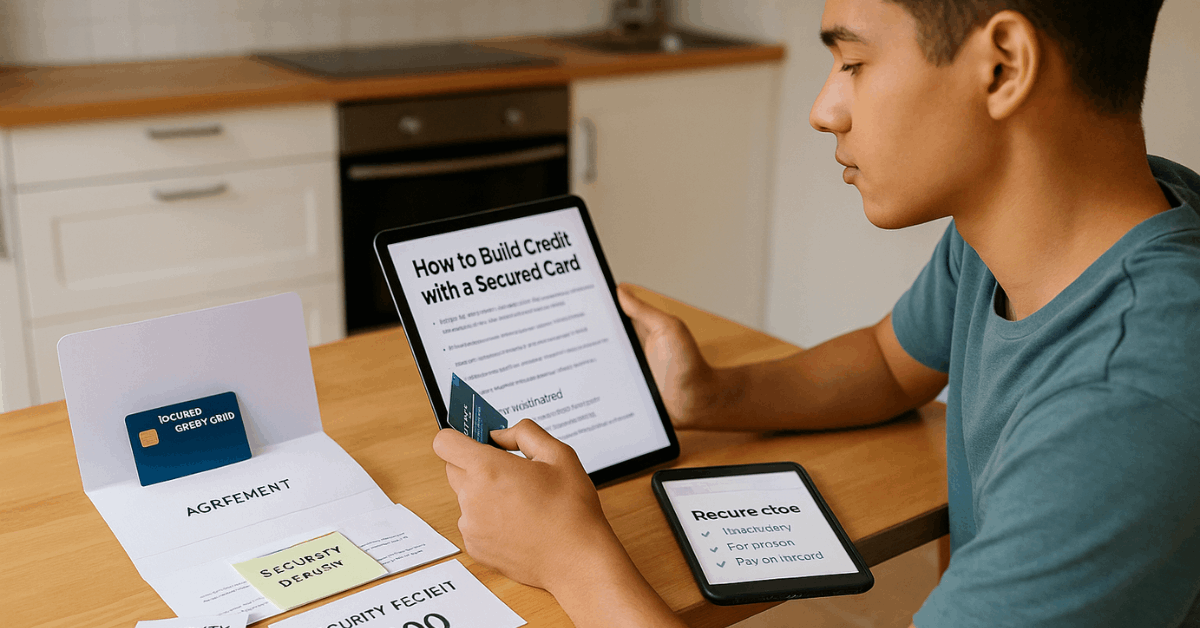

Secured Credit Cards

Banks approve secured cards against a refundable cash deposit, often matching the credit limit, making acceptance easier for thin or damaged files.

Responsible use for six to twelve months frequently qualifies the holder for an unsecured upgrade.

Student Credit Cards

Full-time students with limited income can access lower-limit cards featuring lenient underwriting and occasional rewards. Maintaining a spotless payment history during school lays the groundwork for superior cards after graduation.

Authorized-User Path

Joining an existing account bypasses underwriting completely and delivers immediate history length. This route suits newcomers who lack sufficient income to qualify individually.

Daily Habits That Drive Ongoing Score Growth

Credit building depends on repetition, not one-time fixes. The following routines cement gains.

- Enable autopay and calendar alerts so no due date slips past unnoticed.

- Track balances weekly through the issuer’s app and submit mid-cycle payments if utilization creeps above 10 %.

- Review statement dates and pay large charges before the cycle closes to ensure lower reported balances.

- Store credit limits inside a budgeting app to visualize real-time utilization percentages.

Common Missteps That Lower Credit Scores

Avoiding predictable pitfalls protects hard-won progress.

Excessive Applications

Each new inquiry chips away at the “new credit” category; stacking multiple card applications inside one month often triggers issuer risk algorithms and suppresses scores.

Maxing Out Limits or Exceeding Them

Balances above 90 % of the limit can signal financial distress to scoring models. Crossing the limit entirely often results in penalty fees and immediate score damage.

Missing Payments

A single payment recorded 30 days late can cost scores far more than bringing utilization from 80 % down to 0 %. Autopay remains the simplest defense.

Closing Long-Standing Accounts

Shutting a mature card tightens utilization ratios and chops account age. Weigh those negatives against any benefit gained from trimming fees or reducing fraud exposure.

Building Credit Without Relying on a Card

Cards are effective but not mandatory. Well-managed installment loans also cultivate pa ositive history.

- Credit-builder loans hold your borrowed funds in a secure account until all payments clear, creating a safe environment for initial score generation.

- Student, auto, and personal loans contribute to a variety of payment histories, provided monthly obligations fit comfortably inside your budget.

- Rent and utility reporting services add recurring bill data to specific bureau files, strengthening thin profiles without extra borrowing.

- Experian Boost® and similar tools link paid telecom and streaming accounts to credit reports where accepted.

Monitoring Progress and Adjusting Tactics

Tracking your score through free online dashboards and official bureau reports reveals how each adjustment shifts the numbers.

- Pull a fresh report from each bureau at least annually, if not quarterly.

- Compare month-over-month score changes against recent actions, such as balance pay-downs or new inquiries.

- Set alerts for suspicious activity to quickly catch unauthorized accounts.

When a plateau appears, reassess utilization ratios, payment consistency, and inquiry patterns before initiating drastic steps such as debt consolidation or additional cards.

Conclusion

A well-managed credit card serves as a versatile tool for score improvement when combined with disciplined payment habits, low utilization, and targeted strategic moves.

Autofinance professionals worldwide still recommend treating available credit as a convenience rather than borrowed income.

Follow the structured methods outlined above and review your reports regularly, and your credit profile will strengthen steadily—opening doors to better financing terms and broader financial flexibility over time.