Credit cards have replaced cash for countless everyday transactions worldwide, yet many shoppers still question whether “plastic” belongs in every wallet swipe.

Weighing safety, rewards, budgeting ease, and credit-building potential against fees and overspending risk helps you decide if a card should fund most purchases.

Core Advantages of Daily Credit-Card Spending

Credit cards deliver several built-in benefits that cash, checks, and even debit cards struggle to match.

Safety and Fraud Protections

Carrying a credit card shields your money better than carrying a thick roll of bills. Card networks apply zero-liability rules, so unauthorized charges rarely cost you anything out of pocket when reported promptly.

Losing cash means immediate and permanent loss, while losing a card mainly triggers an account freeze and replacement.

Debit cards offer some safeguards, but refunds may take weeks, placing your everyday budget in limbo and risking bounced payments during the investigation.

Reward Earnings That Stack Up Over Time

Every swipe can earn you cash back, points, or airline miles. A straightforward flat-rate card often yields 1.5 %–2 % worldwide, effectively discounting routine spending on groceries, fuel, and utilities without extra effort.

Pair niche category cards, such as 5 % rotating bonus products or supermarket-specific cards, with a reliable flat-rate option, and the annual haul can approach four-figure territory for an average household.

Maintaining existing spending habits remains critical; inflating purchases to chase points quickly wipes out any gain.

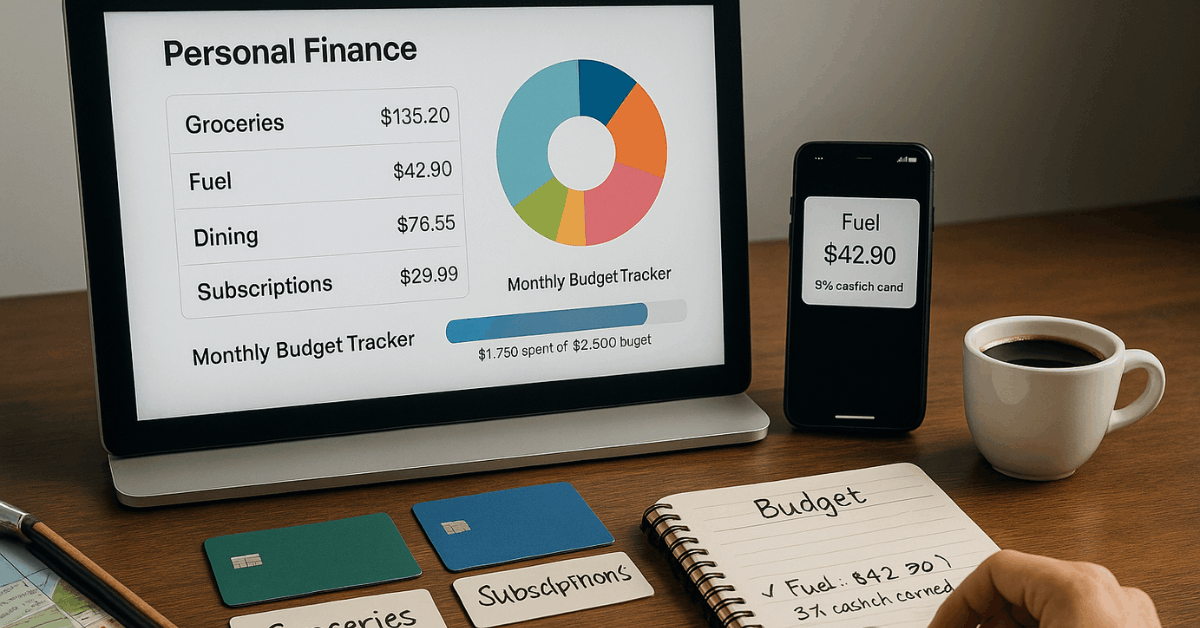

Streamlined Tracking and Budget Insight

Modern issuers post transactions almost in real time, then auto-sort each purchase under categories like groceries, travel, or dining. Monthly and year-to-date reports reveal patterns that manual receipt piles rarely uncover.

Linking your card to budgeting apps further automates analysis, allowing quick comparisons between target and actual spending while highlighting areas for cost trimming.

Cash leaks and forgotten checks become far easier to tame when every charge appears on a digital dashboard.

Credit Building on Autopilot

Using credit regularly and responsibly creates positive payment history and demonstrates controlled utilization to global scoring models.

Timely full payments drive higher scores, opening doors to lower mortgage rates, cheaper insurance premiums, and attractive employment prospects.

Debit swipes, cash spending, and prepaid cards never appear on credit reports, so they cannot strengthen your profile.

Travel and Purchase Benefits Beyond Points

Many leading cards waive foreign transaction fees, add complimentary travel insurance, reimburse Global Entry or TSA PreCheck, provide lost luggage coverage, and grant airport lounge access.

Even at home, extended warranties, purchase protection, and price-drop refunds safeguard big-ticket items. Leveraging these benefits can offset hefty annual fees, but only if you actually travel or buy products that qualify.

Situations Where Cards Might Not Be Ideal

Though powerful, credit cards are not universally optimal. Evaluate context and merchant policies before defaulting to plastic.

Added Surcharges at Checkout

Some retailers offset processing expenses by tacking a convenience fee onto card transactions.

Paying with a card when surcharges exceed your reward rate results in a net loss. Consider debit or cash whenever a posted fee appears unless the purchase is large enough that buyer protections outweigh the surcharge.

Supporting Small Community Merchants

Independent cafés or artisans often operate on slim margins. Card fees eat into their bottom line substantially more than cash payments.

Choosing bills or a low-cost debit card helps them retain a larger share of each sale and foster community relationships.

Guarding Against Personal Overspending

Generous credit limits can dull the pain of immediate payment, nudging some shoppers toward impulse buys.

If maintaining discipline proves difficult, loading fixed daily cash into a prepaid debit option or sticking strictly to budgeted debit withdrawals can curb overspending temptation.

How Everyday Card Use Affects Your Credit Score

Routine credit-card activity can either fortify or harm your profile depending on repayment habits and utilization levels.

Positive Impacts:

- Stronger payment history: Consistent on-time payments supply the single largest boost to credit scoring algorithms.

- Healthy utilization ratio: Keeping statement balances below roughly 30 % of total available credit signals responsible management, aiding score growth.

- Long-term account age: Older open accounts raise average credit age, another metric favoring established reliability.

Negative Impacts:

- Late payments: A 30-day delinquency undermines years of disciplined behavior and remains on reports for up to seven years.

- High balances near limits: Maxed cards push utilization sky-high, immediately depressing scores and hinting at financial stress to future lenders.

Guidelines for Responsible Daily Card Use

Disciplined habits ensure benefits outweigh risks when cards become your primary payment method worldwide.

- Align spending with existing budget: Treat the card like a digital cash proxy rather than new purchasing power.

- Automate full-balance payments: Scheduling automatic drafts eliminates missed-payment surprises and spares interest charges.

- Monitor utilization weekly: Aim to keep each statement cycle under roughly 30 % of available credit; mid-cycle payments can help maintain headroom.

- Set real-time alerts: Many issuer apps notify you instantly after each purchase, reinforcing awareness and highlighting unauthorized activity before damage snowballs.

- Review statements monthly: Scanning for errors, duplicate charges, or category misclassifications refines budget accuracy and supports fraud dispute timelines.

Selecting the Right Card for Worldwide Everyday Spending

Matching card type to lifestyle unlocks maximum value without complicating daily checkout routines.

Flat-Rate Cash-Back Workhorses

A simple 2 % cash-back card delivers predictable returns on every transaction, making it ideal when spending spans diverse categories or when your schedule leaves little room for optimization tactics.

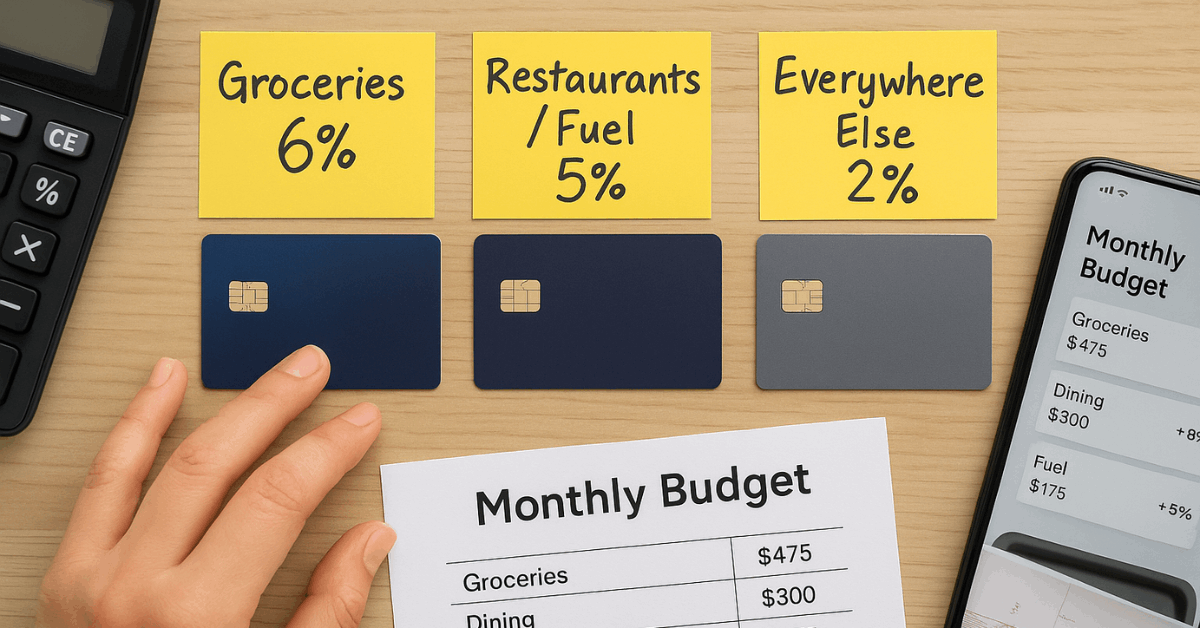

Category Bonus Specialists

Cards offering 3 %–6 % on groceries, fuel, or streaming services thrive when your spending skews heavily toward those areas. Rotating-category products add quarterly excitement, but you must track activation calendars to capture full bonuses.

Premium Travel Cards

Globetrotters may justify annual fees above USD 95 when lounge access, no-fee forex, complimentary insurance, and airline statement credits offset the cost.

Evaluate real travel frequency before committing, because unused perks waste money even if they sound glamorous.

No-Annual-Fee Starters

New credit builders or light spenders often benefit from fee-free cards. Rewards rates sit slightly lower, yet the absence of fixed costs means net gains start immediately after the first swipe.

Acceptance and Network Reach

Ensure the card operates on a widely accepted network, such as Visa or Mastercard, especially for international trips where smaller networks might face limited merchant coverage.

Financing Large Purchases Without Interest

Many issuers advertise zero-percent introductory periods ranging from six to eighteen months.

Leveraging such offers lets you spread appliance or medical expenses across several paychecks without incurring finance charges as long as the entire balance clears before the promotional window closes.

Always mark the expiration date on your calendar because interest typically accrues retroactively on any remaining balance afterward.

Balancing Rewards Against Fees

Reward schemes can lure shoppers into costly annual fees, elevated interest rates, or hidden foreign-transaction charges.

Before selecting a premium product, project realistic annual spending, apply the advertised earn rate, then subtract the fee to gauge net value.

If the math suggests thin margins, a straightforward flat-rate or no-fee alternative often makes more sense.

Practical Example of Everyday Optimization

Imagine a household spending USD 475 monthly on groceries, USD 300 at restaurants, USD 260 on fuel, plus USD 60 on streaming subscriptions and USD 100 on assorted online purchases.

Combining a grocery-focused card at 6 %, a rotating-category card hitting 5 % on restaurants and fuel for half the year, and a constant 2 % everywhere-else card yields nearly USD 1 000 annually in cash back, without spending beyond the original budget.

The same outlay funded by cash would have produced no return and offered weaker protections.

Common Pitfalls and How to Avoid Them

People who have used a credit card for a long time now have fallen at least once or even multiple times on these mistakes in using their credit cards:

- Impulse upgrades: Glossy store-level financing offers sometimes exceed your comfortable budget. Pause for twenty-four hours before committing to large discretionary buys.

- Chasing sign-up bonuses: Meeting high minimum-spend thresholds can push households to overspend. Shift existing unavoidable bills onto the new card rather than inventing new expenses.

- Ignoring statement closing dates: Large transactions just before statements cut inflate reported balances even if you plan immediate payment. Knowing cut-off dates helps keep utilization ratios healthy.

Conclusion

Using a credit card for daily transactions worldwide can streamline budgeting, strengthen credit history, unlock meaningful rewards, and shield your money from fraud, provided spending stays disciplined and fees never outstrip benefits.

Evaluate merchant surcharges, support local businesses thoughtfully, and match card features to genuine lifestyle needs.

Follow consistent payment habits, monitor balances, and your card transforms from a simple payment tool into a quiet engine driving long-term financial flexibility.