Settling an entire statement balance every cycle keeps costs low, yet modern cards also provide tools for stretching payments when bigger expenses hit.

Choosing the right approach requires knowing how balances, interest, and flexible features interact.

How Credit Card Balances Form and Grow

Paying attention to what is in a statement helps you control costs before they spiral.

A balance reflects more than recent purchases. It also includes interest already accrued plus any fees or penalties the issuer added during the cycle.

Key Elements Inside Every Balance:

- Purchase totals: The combined price of each item charged during the billing period.

- Interest charges: Daily accrual based on the card’s annual percentage rate (APR).

- Issuer fees: Items such as annual membership, cash-advance surcharges, or foreign transaction costs.

- Penalties: Late-payment or over-limit assessments that trigger when terms are broken.

Minimum Payment and Due Date

Card issuers calculate a required minimum, often one to three percent of the statement total plus interest already owed. Paying at least that amount by the due date keeps the account current and preserves payment history.

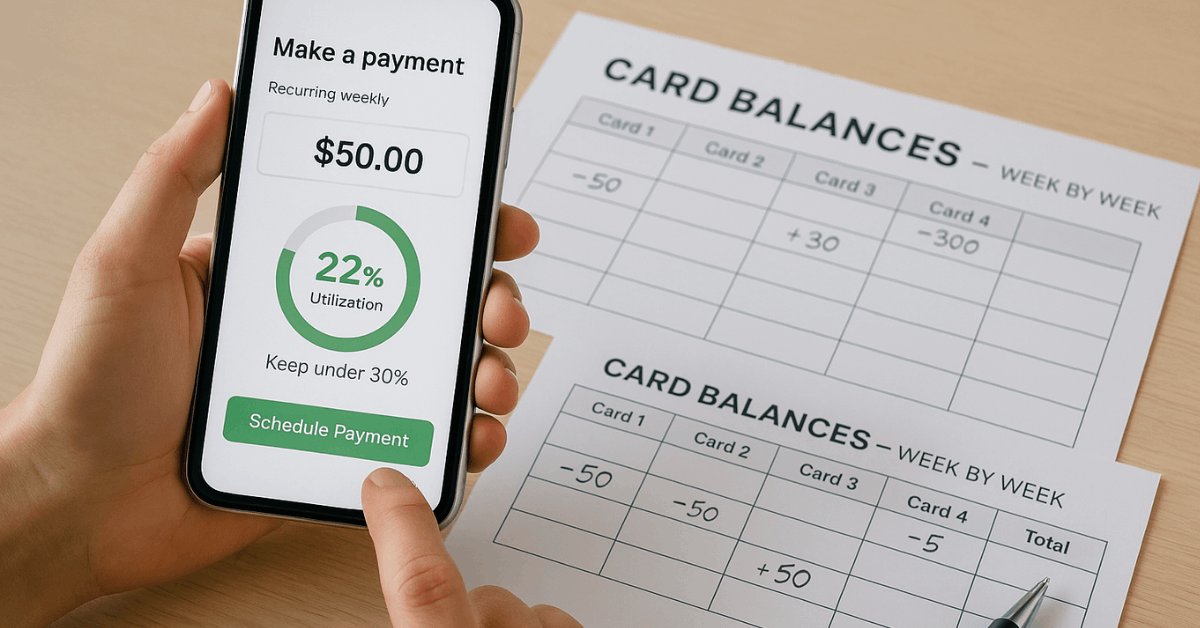

Credit Utilization and Your Score

Lenders review how much revolving credit is being used compared with available limits. Keeping utilization near thirty percent or lower signals responsible borrowing and supports a stronger credit score.

Interest and Fees: What They Really Cost

Interest compounds quickly when balances linger, while seemingly minor fees can stack up and drain budgets.

Annual Percentage Rate (APR)

The APR represents yearly cost, yet issuers apply one-twelfth of that rate to the average daily balance each month. A 20 percent APR effectively equals roughly 1.67 percent every cycle.

Common Fees to Track

| Fee Type | Typical Trigger | Typical Range |

| Late payment | Missing the due date | About $32, higher after repeat offenses |

| Over-limit | Exceeding available credit | $25–$35 per incident |

| Annual membership | Holding certain rewards cards | $0–$550+ |

| Cash advance | Withdrawing cash at an ATM | 3–5 percent of amount |

| Returned payment | Payment reversal or insufficient funds | Similar to late-payment charge |

Avoidable fees should remain rare when alerts are set and balances stay below limits.

Paying in Full Versus Carrying a Balance

Deciding between full payoff and partial payoff influences both short-term cash flow and long-term financial health.

Why Clearing the Statement Each Month Helps:

- Zero interest: No balance means nothing for the issuer to finance, eliminating APR completely.

- Grace period protection: Starting cycles at zero activates 21–25 interest-free days on new purchases.

- Simpler budgeting: Single-cycle repayment encourages spending only what fits next month’s cash flow.

- Score benefits: Low utilization and impeccable payment history boost creditworthiness.

- Higher future limits: Consistent full payoff often prompts issuers to raise limits proactively, granting extra flexibility down the road.

When Carrying a Balance Can Make Sense:

- Unexpected repairs: Spreading a large mechanic bill over several months softens budget shocks.

- Home upgrades: Financing materials through a lengthy 0 percent intro APR window preserves savings.

- Cash-flow timing: Seasonal earners may prefer staggered payments matched to variable income.

Carrying debt should still follow a plan: automate multiple smaller payments to shrink the average daily balance and choose promotional rates where possible.

Credit Cards vs. Charge Cards

Both swipe the same at checkout, yet payment obligations differ significantly.

| Feature | Credit Card | Charge Card |

| Monthly payoff required | No | Yes |

| Revolving balance allowed | Yes, up to credit limit | Not permitted |

| Preset spending limit | Fixed | No preset limit; adaptive |

| Typical issuer | Most banks | Select issuers (e.g., American Express) |

| Interest on unpaid balance | Charged | N/A (balance in full) |

Understanding the difference prevents costly surprises after large purchases.

Flexible Payment Programs for Modern Spending

Traditional charge cards once demanded full payoff, but many now include optional features that mimic revolving credit while preserving higher purchasing power.

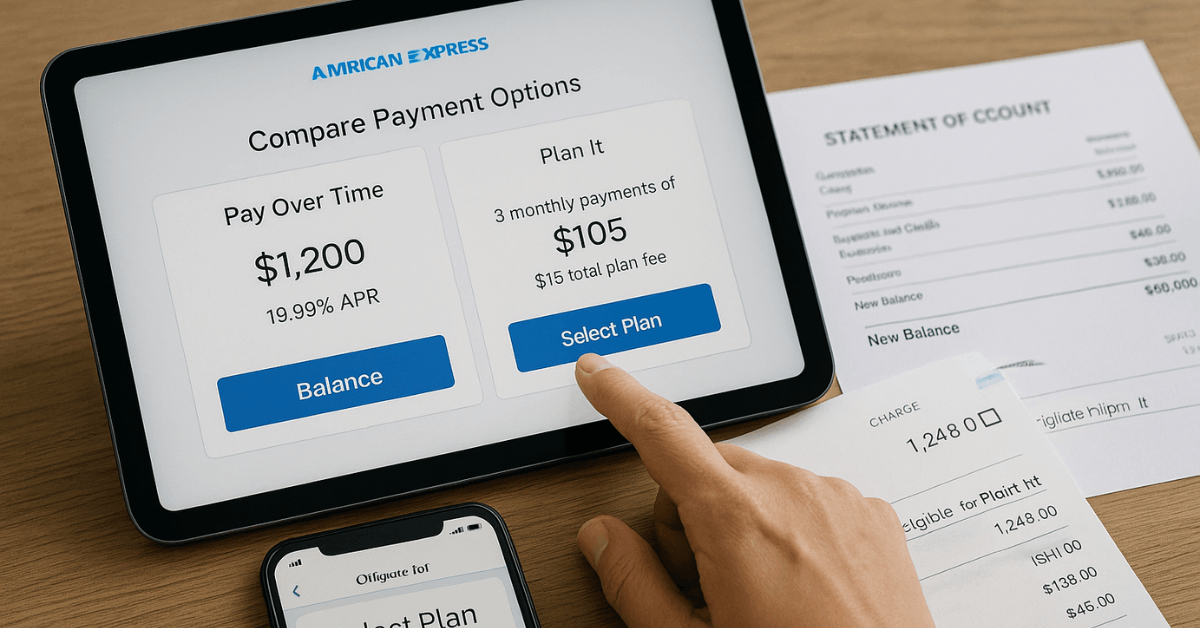

Pay Over Time (American Express Examples)

Pay Over Time lets eligible Platinum, Gold, or Green Card members choose how much of a statement to carry, up to a separate Pay Over Time Limit. Charges beyond that threshold still require full payment.

Core Points:

- Activation is required before making purchases intended for partial payoff.

- Interest applies only to the carried portion, not the entire statement.

- The limit covers Pay Over Time balance plus cash advances and Plan It plans combined.

- Deactivation is possible anytime without a credit pull.

Plan It® Installments

Plan It splits purchases of $100 or more into equal monthly installments plus a fixed fee, avoiding variable interest. Up to ten plans can run simultaneously, offering predictable payoff schedules.

Comparison:

| Feature | Pay Over Time | Plan It |

| Structure | Revolving balance with interest | Fixed installments with fee |

| Eligible charges | Any purchase up to limit | Individual purchases ≥ $100 |

| Interest vs. fee | Variable APR | Up-front fixed charge |

| Activation timing | Before purchase | After posting but before cycle closes |

Choosing between them depends on whether predictability (Plan It) or open-ended flexibility (Pay Over Time) matters more for the situation.

Practical Strategies for Managing Card Debt

Staying disciplined prevents balances from turning into runaway debt.

- Automate at least the minimum to avoid missed-payment penalties and score damage.

- Target utilization under thirty percent by spreading purchases across multiple cards or requesting limit increases when income rises.

- Schedule weekly micro-payments to cut the average daily balance and shave interest.

- Cap installment plans at manageable amounts so overlapping obligations never overwhelm monthly cash flow.

- Review statements line-by-line each cycle for unexpected fees or fraudulent activity.

- Leverage 0 percent transfer offers only when a concrete payoff timeline fits within the promotional window.

Frequently Asked Questions

Common questions answered:

- Is interest ever charged when the entire statement balance is paid?

No interest appears when the full statement amount reaches the issuer before or on the due date, because there is no remaining principal to finance. - Does leaving a small balance improve credit scores?

Scoring formulas reward low utilization and perfect payment records—not the presence of interest-bearing debt. Paying in full serves the score better. - Can one credit card pay another card’s balance?

Issuers generally block direct payments from rival cards, though balance-transfer promotions allow moving debt under specified terms. - How long would minimum payments alone take to clear debt?

Because minimums often equal around two percent of the balance, payoff could stretch across decades while costing multiples of the original amount in interest. - Do grace periods cover cash advances?

Interest on cash advances starts immediately, so grace periods only shield standard purchase transactions.

Conclusion

Clearing a statement in full secures zero interest, protects credit health, and simplifies money management, making it the preferred default strategy worldwide.

Nevertheless, life occasionally brings expenses too large for a single cycle. Modern credit and charge cards address that reality using Pay Over Time, Plan It, 0 percent promotions, and carefully managed revolving balances.

Apply these tools deliberately, use them modestly, and your credit card will remain a resource, not a burden.