Picking a credit card is easier when you break the process into clear, practical steps.

This guide shows you how to match worldwide card options to your spending habits, repayment style, and credit profile.

Define the Main Reason You Want a Card

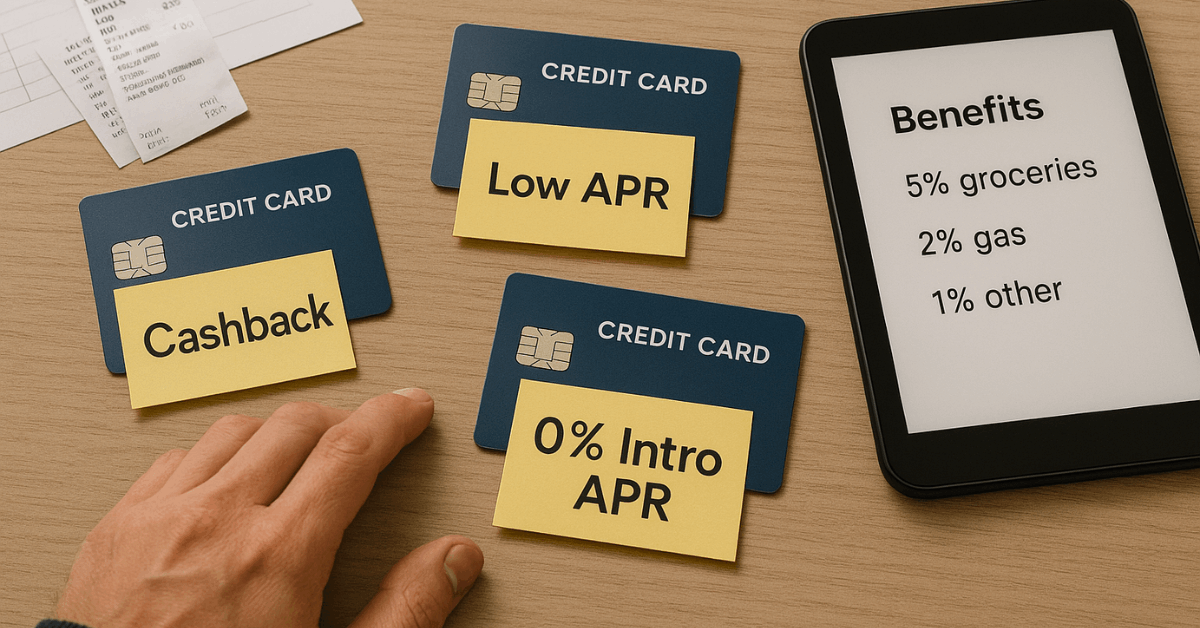

Start with a clear purpose. Knowing exactly why you need a credit card helps you filter through thousands of offers quickly.

Whether it’s for everyday purchases, managing debt, or funding a large expense, your main goal should guide your decision from the start.

Purchases You Will Pay in Full

If you plan to pay off your balance in full each month, your priority isn’t the interest rate; it’s the rewards and perks. Look for cards that offer long interest-free grace periods and provide meaningful benefits.

These often include automatic cash-back rebates, loyalty points that convert to flights or gift cards, and protections like extended warranties or refunds when prices drop after you buy.

Purchases You Will Repay Over Time

If you expect to carry a balance, the cost of borrowing becomes your main concern. Focus on credit cards with a low ongoing APR, ideally with no or minimal annual fees.

You also want clear and predictable repayment terms, so you can manage your monthly payments without unexpected charges.

One-Off Large Expenses

Big-ticket purchases such as weddings, home upgrades, or medical procedures benefit from cards offering introductory 0% APR periods.

These promotional windows typically last between 12 and 21 months.

Some cards also allow you to transfer existing balances, letting you pause interest and concentrate on reducing the principal without pressure.

Know the Core Cost Numbers

Understanding a few headline figures lets you compare cards quickly and avoid hidden charges.

| Cost Item | Why It Matters | Quick Checkpoint |

| APR | Shows the yearly cost of borrowing if you do not pay in full | Lower is better when you expect to carry debt |

| Interest-Free Days | Indicates how long you can avoid interest on new purchases | Longer periods help disciplined payers |

| Annual or Monthly Fee | Adds to your cost even if you never pay interest | Make sure benefits exceed this charge |

| Penalty Charges | Cover late payments, over-limit spending, or foreign transactions | Read the credit agreement fine print |

Review Your Credit Health Before Applying

Checking your credit status before applying for a new card helps you avoid surprises and puts you in a stronger position to get better terms. Don’t rush into applications without knowing where you stand.

Get a Current Credit Report

Start by requesting a credit report from at least one major bureau. You’re entitled to one free copy per year from each.

Reviewing it helps you see your full credit history, open accounts, payment records, balances, and inquiries.

Look for any errors, such as accounts you didn’t open, late payments you know were on time, or incorrect balances. These mistakes can lower your score and reduce your approval odds.

Dispute Errors to Improve Your Score

If you spot issues, file a dispute with the credit bureau. Most investigations finish within 30 days. Fixing even one error, like a wrongly reported late payment, can raise your score quickly and unlock better offers.

Avoid Stacking Applications

Every time you apply for a credit card, the lender performs a hard inquiry. Too many inquiries in a short period can make you look risky, even if your score is good.

To keep your profile strong, space out applications by at least six months unless there’s a clear reason to apply sooner.

Strong Credit Increases Your Leverage

A healthy credit file, free of errors, with on-time payments and low debt levels, makes you more attractive to lenders.

This improves your chances of getting approved for cards with higher credit limits, lower interest rates, and premium-level rewards.

Lenders worldwide use your credit profile to decide what kind of borrower you are, so checking and improving it before you apply gives you a clear edge.

Match Card Type to Your Situation

Each card category serves a different need. The table below compares the main options at a glance.

| Card Type | Best For | Typical Credit Needed | Key Trade-Off |

| Rewards | Frequent spenders who pay in full | Good to excellent | Possible annual fee |

| Balance Transfer | Clearing existing high-interest debt | Good to excellent | Upfront transfer fee (3–5%) |

| 0% Intro APR | Financing large purchases interest-free | Good to excellent | Standard APR applies after promo |

| Student | College students building history | Limited or no credit | Lower limits, basic perks |

| Secured | Rebuilding poor credit | Any score | Deposit equals limit |

| Store | Loyalty to one retailer | Fair to good | Usable mainly at that brand |

Set a Sensible Credit Limit

Providers often offer more credit than you need. Accept a limit that fits the repayments you can clear within three years. Lower limits encourage controlled spending and keep utilization ratios healthy.

Evaluate Extra Features Realistically

Perks only matter when you actually use them.

- Rewards programs deliver value if earnings exceed higher fees or rates.

- Travel insurance attached to premium cards helps frequent flyers but adds cost.

- Cash-back boosts justify themselves only when you repay in full and avoid interest.

Run the numbers with a credit card calculator to confirm the benefit outweighs additional charges.

Compare Cards Efficiently

Comparison sites provide quick snapshots, yet they rarely list every issuer. Combine three methods:

- Visit at least two independent comparison platforms.

- Check direct offers on major bank websites for cards missing from aggregators.

- Use each issuer’s summary box to line up rates, fees, and promotional periods side by side.

This blended approach captures niche products and uncovers limited-time worldwide deals that one site might miss.

What is the Application Process?

A smooth application boosts approval odds and speeds card delivery.

- Complete the online, branch, or phone form accurately; mistakes can be flagged as fraud.

- Provide stable income details and housing history to strengthen your profile.

- Review and sign the credit agreement, confirming borrowing limit, repayment schedule, interest terms, and your rights.

Consider whether to add authorized users. Their spending becomes your liability, so agree on clear rules before sharing the card.

Handle a Rejection Constructively

A denial does not close the door. Follow this sequence:

- Read the adverse action notice to pinpoint reasons.

- Check your credit reports for issues such as high utilization or missed payments.

- Call the issuer’s reconsideration line if you can clarify income, move available credit, or correct data.

Improve weak areas, reduce balances, pay on time, and limit new inquiries, then apply for a card matched to your current score range.

Maintain Smart Habits After Approval

Responsible use protects your credit and maximizes benefits.

- Pay the statement balance within the grace period to avoid interest.

- Keep utilization below 30 percent; lower is better.

- Schedule automatic payments to eliminate late fees.

- Reassess your card lineup every 12–24 months as your income, credit score, and travel patterns evolve.

Switch or add cards when new products offer clearer value, but close old accounts sparingly to preserve credit history length.

Conclusion

Selecting the best credit card hinges on how you plan to spend, when you will repay, and your current credit score.

Define your goal, compare the true costs, and pick a card that serves your current needs while leaving room to upgrade later.

With disciplined repayments and periodic reviews, you will keep fees low, rewards high, and borrowing stress-free—worldwide.