Modern credit cards do more than handle everyday payments. They stretch budgets through generous cash-back rates, unlock airport lounges, and smooth large purchases with year-long 0 % interest windows.

The offers below rank among the strongest available worldwide in 2025, organised by the benefit that matters most to you.

Top Credit Card Offers at a Glance

The cards in this section illustrate how leading issuers balance fees, rewards, and perks in 2025.

| Category | Stand-Out Card | Annual Fee | Prime Benefit |

| Longest 0 % APR window | Wells Fargo Reflect® | $0 | Up to 21 months 0 % on purchases and transfers |

| All-around cash back | Chase Freedom Unlimited® | $0 | Up to 5 % back in everyday categories |

| Luxury travel experience | Amex Platinum® | $695 | Global lounge access + hundreds in annual credits |

| Bonus travel rewards | Chase Sapphire Preferred® | $95 | 75 k-point welcome bonus + 5 × on Chase-Travel spend |

| Dining & entertainment | Capital One Savor® | $0 | 8 % back on Capital One Entertainment purchases |

| Simple flat-rate travel | Capital One Venture® | $95 | Unlimited 2 × miles on every purchase |

| Straight 2 % cash back | Wells Fargo Active Cash® | $0 | Unlimited 2 % on all spend worldwide |

| Premium portal perks | Capital One Venture X® | $395 | 10 × miles on portal hotels + $300 annual credit |

| Rotating 5 % categories | Discover it® Cash Back | $0 | Quarterly 5 % categories + 18-month 0 % BT offer |

| High-end points suite | Chase Sapphire Reserve® | $795 | 8 × points on portal purchases + $300 travel credit |

| Household stand-by | Amex Blue Cash Preferred® | $0 first year, then $95 | 6 % back on supermarkets + streaming |

| Zero-fee balance relief | Citi Simplicity® | $0 | Up to 21 months 0 % balance-transfer window |

| Long intro + side perks | U.S. Bank Shield™ Visa® | $0 | 18 billing cycles 0 % APR + 4 % travel portal cash back |

(Card names and terms change regularly; always confirm current details before you apply.)

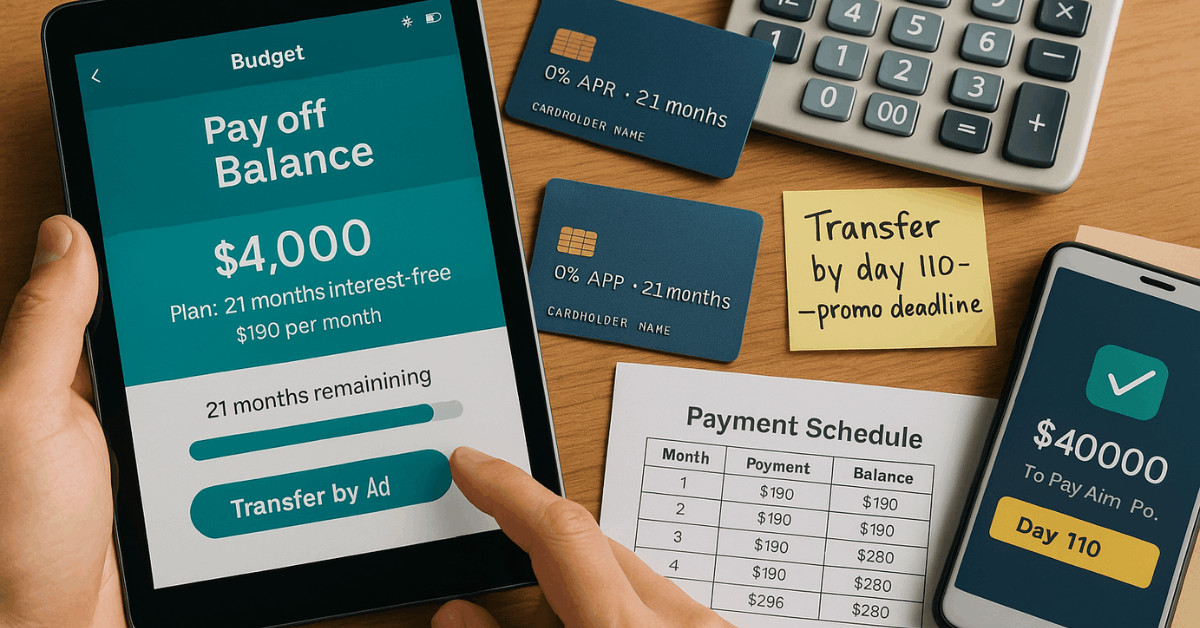

Longest 0 % APR Window

Extending interest-free time smooths large purchases and aggressive balance-transfer plans.

Wells Fargo Reflect® grants up to 21 months of 0 % APR on both purchases and qualifying transfers, giving you nearly two years to clear debt without interest drag. A zero-dollar annual fee keeps carrying costs low, and built-in cell-phone protection worth up to $600 adds quite value for anyone prone to screen mishaps.

Why it stands out:

- 21 months introductory 0 % APR on purchases and transfers

- Transfers completed within 120 days keep the promo rate

- Automatic extension of the intro period with on-time payments

- Complimentary cell-phone coverage worldwide (subject to deductible)

All-Around Cash-Back Leader

Earning strong returns across multiple categories maximises everyday spending power.

Chase Freedom Unlimited® delivers up to 5% back on portal travel purchases, 3% on dining and drugstores, and 1.5% on everything else. A $200 sign-up bonus after just $500 in three months puts early cash in your pocket, while a 15-month 0 % APR gives breathing room on new buys and transfers.

Key advantages:

- Broad 3 % and 5 % bonus areas with no rotating hoops

- 1.5 % floor rate beats ordinary 1 % cards worldwide

- Cash-back credits never expire while your account stays open

- Zero foreign transaction fee simplifies international trips

Luxury Travel Experience

High fees can pay off when perks far exceed the annual cost.

The Platinum Card® from American Express earns 5 × points on flights and prepaid hotels through American Express Travel, caps your airport waits through Priority Pass and Centurion Lounges, and hands out more than $1,500 in yearly statement credits covering digital entertainment, Uber, airline fees, CLEAR, and Saks purchases. If you travel frequently worldwide, lounge access alone justifies the steep annual fee.

Signature features:

- 5 × travel points on up to $500k in airfare per calendar year

- Global Lounge Collection: over 1,300 lounges across continents

- $200 airline fee credit plus $200 fine-hotel credit each year

- Monthly Uber Cash and digital-subscription credits offset routine costs

Bonus Travel Rewards

Travel enthusiasts wanting rich points without a four-figure fee find a strong middle ground here.

Chase Sapphire Preferred® costs $95 yet yields 5 × points on portal travel, 3 × on dining, streaming, and online groceries, plus an annual $50 hotel credit. Transfer partners such as United MileagePlus, Emirates Skywards, and World of Hyatt stretch points well beyond one-cent cash-out value.

Benefit highlights:

- 75 k-point welcome offer worth $900+ through transfer partners

- Annual 10 % points boost tied to total spend

- Primary rental-car damage waiver is ideal for road trips worldwide

- Transfer partners unlock first-class cabins and upscale hotels

Dining & Entertainment Powerhouse

Entertainment-heavy households recover serious cash when the card matches lifestyle habits.

Capital One Savor® returns 8 % on Capital One Entertainment bookings, 5 % on portal travel, and 3 % on dining, entertainment, streaming, and groceries (excluding select superstores). International travellers appreciate the absence of foreign transaction fees, and there is still no annual charge despite premium rates.

Core strengths:

- 8 % on concert tickets, theme-park passes, and live events

- 3 % on dining and groceries, filling two frequent budget areas

- 15-month 0 % APR on purchases and transfers helps plan big occasions

- One-time $200 bonus after spending $500 in three months

Simple Flat-Rate Travel Card

Flat-rate earners suit globetrotters who dislike tracking rotating charts.

Capital One Venture® hands you 2 × miles on every purchase everywhere and 5 × on portal hotels, rental cars, and vacation rentals. Miles erase any travel charge at a penny each or transfer to 15-plus airline and hotel partners for outsized value.

Why it remains popular:

- Straightforward 2 × earnings on general spend worldwide

- 75 k-mile sign-up boost equals roughly $750 in statement credits

- Global Entry/TSA PreCheck fee reimbursement every four years

- Transfer flexibility plays well with international frequent-flyer programs

Straight 2 % Cash-Back Workhorse

A flat cash-back card pairs neatly with rotating-category products.

Wells Fargo Active Cash® pays an unlimited 2 % on everything, posts a $200 sign-up credit after $500 spend, and adds up to $600 in cell-phone protection: global acceptance rates rival major competitors, and no annual fee locks in long-term value.

Primary benefits:

- Reliable 2 % return without category tracking

- 12-month 0 % APR on purchases and transfers for short-term financing

- Cash rewards never expire while the account is open

- Complimentary Visa Signature concierge for travel and event planning

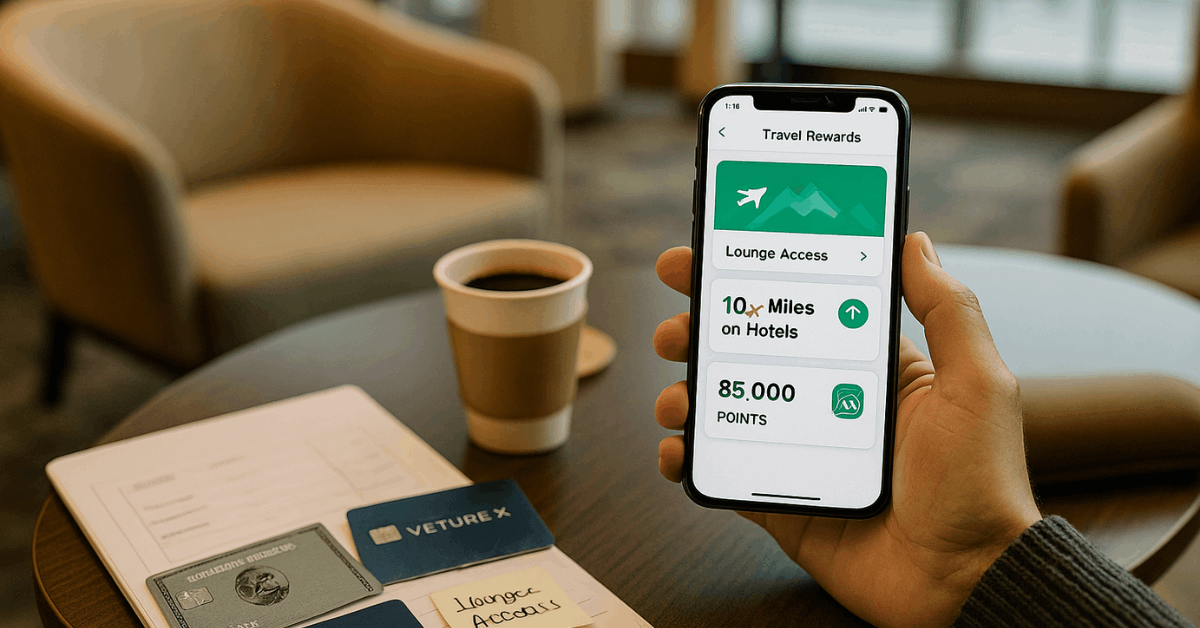

Premium Portal Benefits

Frequent travellers who book through an issuer portal can multiply returns quickly.

Capital One Venture X® lifts portal hotels and rental cars to 10 × miles and flights to 5 ×, stacks a $300 annual credit against portal bookings, then awards 10,000 bonus miles each account anniversary. Complimentary Priority Pass and Capital One Lounge access enrich long journeys, offsetting the $395 fee for many members.

Top reasons to consider:

- High portal multipliers plus anniversary 10 k-mile gift

- $300 travel credit effectively shrinks the annual cost to $95

- Unlimited 2 × miles on non-portal spend maintains simple earning

- Transfer partners mirror the Venture card for strategic redemptions

Rotating 5 % Categories with Long Balance Relief

Category activation can deliver standout rates for disciplined users.

Discover it® Cash Back matches all first-year earnings automatically and rotates 5 % categories quarterly up to the activation cap. An 18-month 0 % balance-transfer window lifts pressure on existing balances, and the issuer still charges no annual fee.

High points:

- First-year Cashback Match doubles initial rewards haul

- 5 % categories often include supermarkets, gas, and online wallets

- Digital card available for immediate use upon approval

- Lower acceptance abroad means you may need a backup card worldwide

High-End Points Suite

Travellers chasing first-class cabins and premium dining credits gravitate here.

Chase Sapphire Reserve® delivers 8 × points on portal travel, 4 × on direct bookings, 3 × on dining, a $300 flexible travel credit, and full Priority Pass lounge membership. Although the $795 fee is steep, the yearly credits, partner transfers, and extensive insurance suite can exceed that cost if you travel multiple times worldwide.

Standout capabilities:

- 100 k-point welcome boost plus $500 travel credit

- Complimentary memberships: Priority Pass, Global Entry/NEXUS/TSA PreCheck

- 1.5 × point value on portal redemptions beats simple cash-out rates

- Annual dining credits through curated Sapphire Reserve Exclusive Tables

Household Cash-Back Champion

Families with large grocery and streaming budgets appreciate steep category multipliers.

Amex Blue Cash Preferred® returns 6% at worldwide supermarkets (up to $6,000 annually, then 1%), 6% on select streaming, and 3% at gas stations and transit. The $95 fee is waived the first year, and a $250 statement credit after $3,000 spend softens the second-year transition.

Why families enjoy it:

- 6 % supermarket rate outpaces many rivals across continents

- 12-month 0 % APR on purchases and transfers for big household buys

- Disney Bundle credit stretches family entertainment budgets further

- Plan It® feature splits large purchases into fixed-fee instalments

Pure Balance-Transfer Focus

Saving on interest trumps rewards when consolidating debt.

Citi Simplicity® extends 21 months of 0 % APR on transfers and 12 months on new purchases. There are no late fees, penalty APRs, or annual fees ever. If debt payoff is your only goal, simplicity wins worldwide.

Key traits:

- Market-leading 21-month balance-transfer window

- Absence of penalty rate protects missteps during pay-down

- Instant card lock tool adds security in compromised scenarios

- No rewards keep focus on debt elimination

How Credit Card Rewards Work

Rewards programs fall into two basic payout styles: cash back or points/miles. Each style operates under either a flat-rate or bonus-category structure.

| Reward Style | Flat-Rate Example | Bonus-Category Example |

| Cash back | 2 % on every purchase (Active Cash) | 5 % on dining, 1 % elsewhere (category caps) |

| Points/miles | 2 × miles on all spend (Venture) | 5 × on portal travel, 3 × dining, 1 × other (Sapphire Preferred) |

You boost returns by pairing a strong flat-rate card with one or two bonus-category cards, funneling each purchase where the multiplier is highest.

Unused cash back never expires while the account stays open, and transferable points convert into premium cabin seats or upscale hotels for far more than one cent each.

Main Credit Card Types Available Worldwide in 2025

Selecting the right category matters as much as the specific card.

- Rewards Cards – Deliver cash, points, or miles; ideal when you pay balances in full each month.

- Interest-Saving Cards – Emphasise low ongoing APRs or extended 0 % promo periods for large expenses or debt consolidation.

- Credit-Building Cards – Provide straightforward terms and report every payment to credit bureaus, allowing newcomers to establish or rebuild scores quickly.

Choosing the Right Card Step-by-Step

Selecting a card becomes simpler when you follow a clear process.

- Check your credit profile using a reputable service to gauge realistic approval odds.

- Define your primary goal: rewards, interest savings, or credit growth. Choose one focus to prevent dilution.

- Estimate annual spending by category to quantify potential rewards or fee offsets.

- Compare key terms such as annual fee, intro APR length, and foreign-transaction charges.

- Evaluate secondary perks—lounge passes, cell-phone insurance, or partner-transfer options—only after core math works.

- Apply strategically; multiple hard pulls in quick succession may lower approval chances.

Feature Comparison Checklist

Before hitting “submit,” confirm that the card aligns with your objectives.

- Annual fee versus projected rewards or credits

- Introductory APR duration and applicable transactions

- Ongoing variable APR for months after the promo ends

- Sign-up bonus requirements and spending timeline

- Rewards structure—flat versus category multipliers

- Perks inventory—travel credits, purchase protection, concierge access

- Foreign transaction fees affect worldwide usage

- Credit-building tools such as free score monitoring or soft-pull pre-approval

Managing Multiple Cards Responsibly

Holding several cards increases available credit and boosts overall rewards, but demands discipline.

- Utilisation control: Aim to keep combined balances below 30 % of total limits, or 10 % for optimal score impact.

Due-date management: Set calendar alerts or automatic payments to avoid late fees.

Redemption tracking: Regularly convert points or cash back before they lose value through program changes.

Backup acceptance: Carry at least one network-diverse option (Visa, Mastercard, American Express, Discover) to cover acceptance gaps worldwide.

Final Takeaway

The best credit card for 2025 matches your lifestyle, spending patterns, and financial goals.

Define the single benefit, interest relief, rich cash back, premium travel access, that matters most to you, verify that projected value outpaces any fees, then apply with confidence.

Maintain on-time payments and moderate utilisation, and every swipe can work harder for your money worldwide.